When people talk about blockchain “layers”, they are really talking about splitting work into different parts. One layer focuses on core security and recording who owns what, while another layer focuses on doing lots of user activity quickly and cheaply. On popular networks like Ethereum, heavy demand can make transactions slow and expensive. Layer 1 blockchains try to stay decentralized and secure, which limits how much they can scale directly. Layer 2 solutions were created to handle more transactions without throwing away that security. Instead of replacing Layer 1, most Layer 2s sit on top of it and regularly send data or proofs back down. You can think of them as extra lanes added above an already secure road. Understanding what each layer is responsible for helps you choose where to hold value, where to trade, and where to build apps.

Quick Take: Layer 1 vs Layer 2 at a Glance

Summary

- Layer 1 = base chain for security, consensus, and final settlement (e.g., Bitcoin, Ethereum, Solana).

- Layer 2 = scaling layer that batches or offloads execution but relies on an L1 for security (e.g., Arbitrum, Optimism, zkSync, Base).

- Layer 1 fees are typically higher and more volatile, especially during peak demand.

- Layer 2 fees are usually much lower because many transactions share the same L1 cost.

- Layer 1 is best for large value storage, final settlements, and core protocols; Layer 2 is best for frequent trades, gaming, and high-volume dApps.

Understanding Blockchain Layers Without the Jargon

- Blockchain: a shared, append-only database where transactions are grouped into blocks and secured using cryptography.

- Protocol: the set of rules that define how a blockchain network operates, including how nodes communicate and validate data.

- Consensus: the process by which nodes in the network agree on the current state of the blockchain and which blocks are valid.

- Settlement: the point at which a transaction is considered final and irreversible on a blockchain.

- Execution: the process of running transaction logic, such as smart contracts, to update balances and state.

- Data availability: the guarantee that transaction data is published and accessible so anyone can verify the chain’s state.

What Is a Layer 1 Blockchain?

- Ordering and including transactions into blocks in a consistent global history.

- Running consensus so that honest nodes agree on which blocks are valid.

- Providing final settlement of transactions once blocks are confirmed.

- Storing and updating the global state, such as balances and smart contract data.

- Issuing and managing the native asset (e.g., ETH, BTC, SOL) used for fees and incentives.

- Ensuring data availability so anyone can verify the chain independently.

- Enforcing base protocol rules like block size, gas limits, and validator requirements.

What Is a Layer 2 Blockchain?

- Optimistic rollups: batch transactions off-chain and assume they are valid unless someone submits a fraud proof within a challenge window.

- ZK-rollups: bundle transactions and submit a succinct cryptographic proof to the Layer 1 that verifies correctness.

- State channels: lock funds on Layer 1 and allow many instant off-chain updates between a small group, settling the final result back on-chain.

- Validiums: similar to ZK-rollups but keep most data off-chain, relying on external data availability solutions.

- Plasma-style chains: older designs that move most activity off-chain and rely on periodic commitments and exit games on Layer 1.

How Layer 1 and Layer 2 Work Together

When to Use Layer 1 vs Layer 2

Not every blockchain action needs the full weight and cost of a Layer 1 behind it. For many everyday tasks, a well-designed Layer 2 offers more than enough security at a fraction of the price. Think in terms of value and frequency. High-value, infrequent moves can justify higher fees and slower confirmation on the base chain. Low-value, frequent actions benefit from the speed and low cost of L2s. By mapping your activities to the right layer, you can save money and reduce congestion while still using the same underlying ecosystem.

Use Cases

- Long-term, high-value storage of assets or NFTs on Layer 1 for maximum security and finality.

- Active DeFi trading, yield farming, and frequent swaps on Layer 2 to minimize fees and slippage from gas spikes.

- On-chain gaming and micro-transactions on Layer 2, where low latency and tiny fees are essential.

- NFT minting strategy: mint or settle final ownership on Layer 1, but run drops, airdrops, or in-game NFT activity on Layer 2.

- Payroll or recurring payouts: batch salary or creator payments on a Layer 2, then occasionally settle treasury movements on Layer 1.

- Cross-border payments: use Layer 2 for fast, cheap transfers, with periodic consolidation or compliance-related moves on Layer 1.

Case Study / Story

Security and Risk: Layer 1 vs Layer 2

Primary Risk Factors

Layer 2s are designed to inherit the security guarantees of their Layer 1, but the story is not that simple. They rely on extra components such as bridges, sequencers, and complex smart contracts, each of which can introduce new attack surfaces. Bridge contracts have been a frequent target of hacks, with bugs or misconfigurations leading to large losses or frozen funds. Centralized sequencers can, in theory, censor or reorder transactions, and proving systems are still relatively new and complex. For users, there are also practical risks: sending funds to the wrong chain, misunderstanding withdrawal times, or trusting very new L2s with little auditing or monitoring. Treat each Layer 2 as its own system to evaluate, even if it connects to a strong Layer 1 like Ethereum.

Primary Risk Factors

Security Best Practices

- Always use official bridge links, learn the withdrawal rules of each L2, and avoid parking all your funds on very new or unaudited networks.

Side-by-Side: Layer 1 vs Layer 2

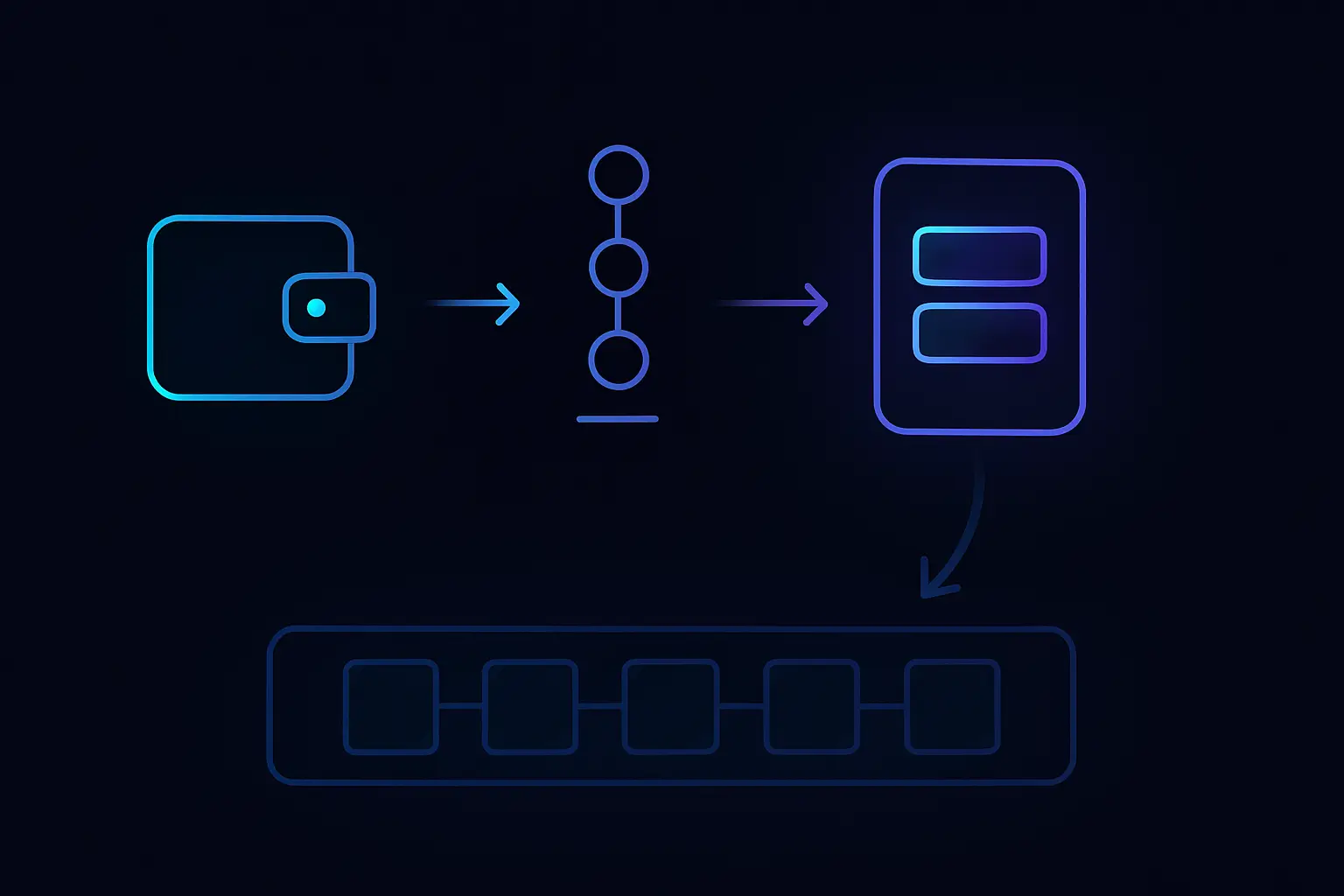

Getting Started: Using an L2 If You’re on an L1

- Research and choose a reputable Layer 2 that supports the apps or tokens you need, checking audits and community reputation.

- Once funds arrive on the Layer 2, explore dApps, confirm network selection in your wallet, and try a small transaction.

- Before sending large sums, read the withdrawal documentation so you understand delays, fees, and any special steps to return to Layer 1.

Layer 1 vs Layer 2: Frequently Asked Questions

Bringing It Together: How to Think About Layers

May Be Suitable For

May Not Be Suitable For

Layer 1 blockchains are the security and settlement base of an ecosystem. They move more slowly, cost more per transaction, and change less often, but they are where final truth is recorded and defended by a broad set of validators. Layer 2s are the scalability and UX layer. They sit on top of a strong Layer 1, handling most day-to-day activity with lower fees and faster confirmations, then anchoring results back to the base chain. When you decide where to transact or build, ask three questions: how valuable is this activity, how often will it happen, and how much complexity am I willing to manage? For most people, the answer is a mix: keep important, long-term value on Layer 1, and use Layer 2s for everyday actions after testing them with small amounts first.