A crypto address is like a destination label on a blockchain: it tells the network where to credit or debit coins when someone sends a transaction. Instead of a name and bank account number, you get a long string of letters and numbers, or a QR code, that uniquely identifies where funds should go. These addresses can look intimidating at first, especially because different coins and networks use different formats. But you do not need to understand the deep math behind them to use them safely. In this guide, you’ll learn what crypto addresses are, how they’re created from public and private keys, and why they differ between Bitcoin, Ethereum, and exchanges. You’ll also see step-by-step usage, common risks, and simple habits that help you avoid sending money to the wrong place.

Quick Summary: Crypto Addresses in a Nutshell

Summary

- A crypto address is a unique, public destination on a blockchain where funds can be sent and received.

- Each address is tied to a private key, which controls the funds; the private key must never be shared.

- Different blockchains and even different address types (for example BTC legacy vs SegWit) use different formats and are not always compatible.

- Transactions to a valid address are usually irreversible, so you must verify the address and network before sending.

- Use copy-paste or QR codes instead of typing, and always confirm the first and last few characters match your intended address.

- When in doubt, send a small test amount first, then send the full payment once you see it arrive correctly.

Building an Intuitive Mental Model

- Like an email or bank account number, a crypto address is a public identifier you can safely share to receive value.

- Unlike bank accounts, there is usually no central support team to fix a wrong transfer once it is confirmed on the blockchain.

- Crypto addresses are often longer and more complex than IBANs or emails because they are derived from cryptographic keys, not chosen by humans.

- Many wallets can generate many different addresses for you automatically, while your bank typically gives you only one or a few account numbers.

- Blockchain balances are visible to anyone who knows the address, unlike typical bank accounts, but the real-world identity behind an address is not always obvious.

Anatomy of a Crypto Address

Key facts

Pro Tip:When verifying a crypto address, focus on the first 4–6 characters and the last 4–6 characters rather than the whole string. This is usually enough to spot a mismatch without overwhelming your eyes. Always compare these characters between the source (wallet, invoice, or exchange) and the destination screen just before you press Send or Confirm.

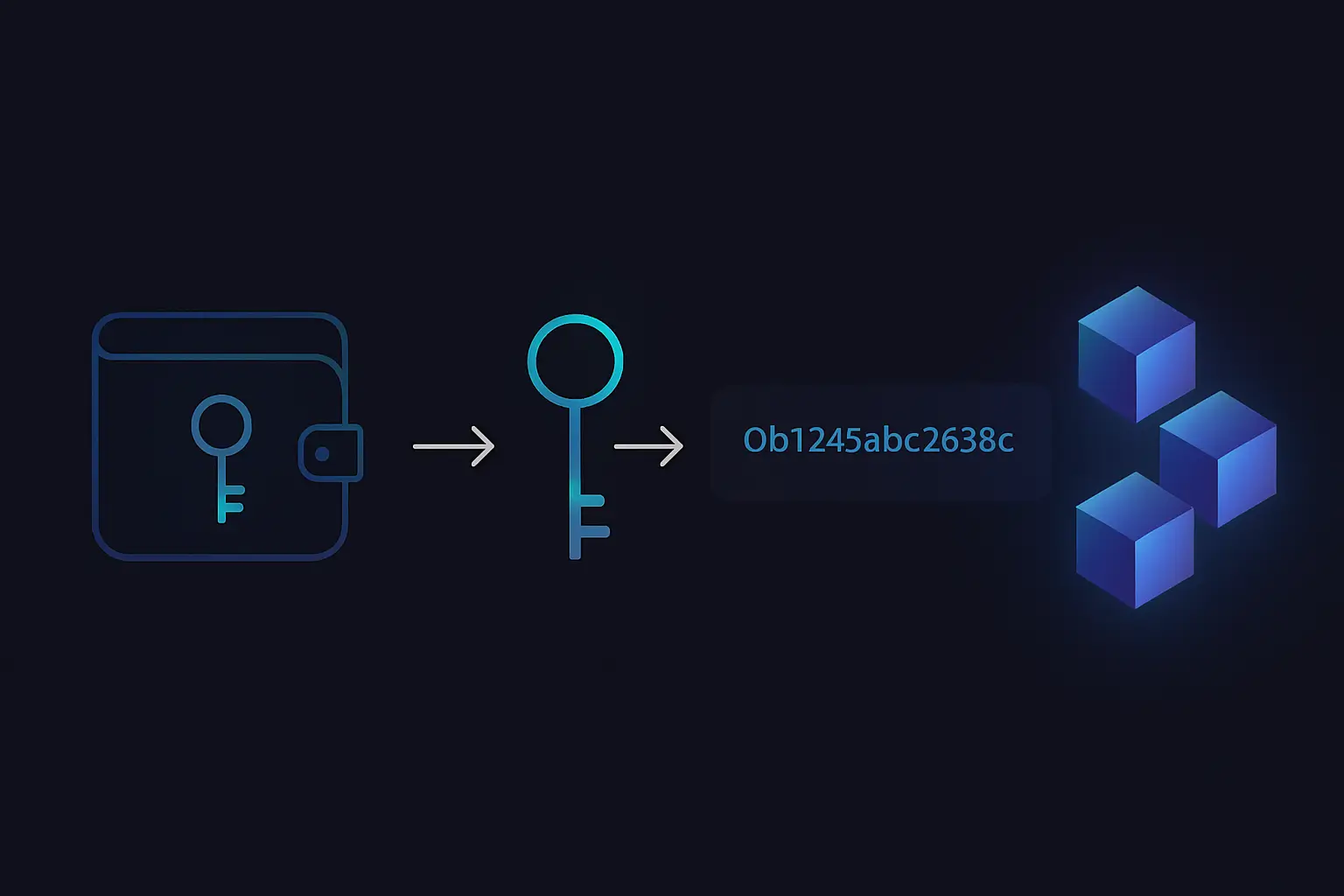

How Crypto Addresses Actually Work (Under the Hood)

- You paste or scan the recipient’s crypto address into your wallet and choose the correct coin and network.

- Your wallet builds a transaction that says “move X amount of this asset from my address to the recipient address” and signs it with your private key.

- The signed transaction is broadcast to the blockchain network, where nodes check that the signature is valid and you have enough balance.

- Miners or validators include the transaction in a block, after which it gains confirmations and becomes very hard or impossible to reverse.

- Once confirmed, the blockchain’s state updates so that the recipient address now shows the new funds and your address shows the reduced balance.

Types of Crypto Addresses and Networks

- Bitcoin legacy vs SegWit addresses: different prefixes (1, 3, bc1) but all used for BTC; some older services may not support the newest formats.

- Ethereum / EVM addresses: 0x-style addresses used on Ethereum and many compatible chains, but the network (ETH, BNB Chain, Polygon, etc.) must still be chosen correctly.

- Exchange deposit addresses with memo/tag: some coins like XRP or XLM require both an address and a memo/tag to credit your specific account.

- Network-specific formats: blockchains like Solana, Cardano, or Tron use their own unique address styles that are not interchangeable with BTC or ETH formats.

- Smart contract addresses: on some chains, contracts have addresses too; sending to them may behave differently than sending to a normal user wallet.

Everyday Uses of Crypto Addresses

You will encounter crypto addresses anytime you move coins on or off an exchange, pay someone, or connect to a Web3 app. They are the basic building blocks of almost every real-world crypto action. Understanding how to read, share, and verify addresses makes everyday tasks like getting paid, investing, or donating much safer and less stressful. Instead of guessing, you will know exactly what to check before you hit Send.

Use Cases

- Sharing your wallet address with a client so they can pay you in stablecoins or another cryptocurrency for freelance work.

- Sending coins from a centralized exchange to your personal wallet address for long-term holding or self-custody.

- Paying friends or family by scanning their QR code address in a mobile wallet instead of using bank transfers.

- Depositing funds to a DeFi protocol by connecting a wallet that controls a specific address and approving transactions from it.

- Donating to a charity that publishes verified crypto addresses on its official website or social channels.

- Receiving staking rewards or airdrops to the same address where you hold your eligible tokens.

- Using a hardware wallet that generates addresses for you, then copying those addresses into other apps for secure receiving and sending.

Case Study / Story

Using Crypto Addresses Step by Step

- Get the correct recipient address from your contact, invoice, or exchange deposit page, and confirm which coin and network it is for.

- Copy the address using the copy button or scan the QR code; avoid typing the address manually whenever possible.

- Paste the address into the recipient field, then compare the first and last 4–6 characters with the original source to make sure they match.

- If the amount is significant, send a small test transaction first and wait until it arrives and is confirmed on the recipient side.

- Once the test is successful, send the full amount, review all details on the confirmation screen, and only then approve or sign the transaction.

Risks, Mistakes, and Security Around Addresses

Primary Risk Factors

Most blockchain transactions are final once confirmed, with no built-in undo button. That makes address-related mistakes some of the most painful errors in crypto. The good news is that most of these risks can be avoided with a few simple habits: always copy from a trusted source, double-check the address and network, and be suspicious of anything that asks for your private key or seed phrase.

Primary Risk Factors

Security Best Practices

- Build a small routine around every send: use an address book or saved contacts for people you pay often, and still verify the first and last characters each time. For new or large payments, always start with a small test transaction before sending the full amount.

Advantages and Limitations of Crypto Addresses

Pros

Cons

Crypto Addresses vs. Traditional Account Identifiers

Human-Readable Names and the Future of Addresses

Crypto Address FAQ

Key Takeaways: Using Crypto Addresses with Confidence

May Be Suitable For

- New crypto users who want to send and receive coins safely

- Freelancers and small businesses accepting crypto payments from clients

- Exchange users moving funds to self-custody wallets

- People confused by different address formats and networks

May Not Be Suitable For

- Developers looking for deep cryptography or protocol-level details

- Traders needing advanced on-chain analysis or forensics

- Users seeking tax or legal advice about crypto transactions

- People who only use custodial apps and never handle addresses directly

Crypto addresses may look intimidating at first, but they are just structured labels that tell the blockchain where to send and track funds. You do not need to memorize them or understand every technical detail to use them safely. By grasping the basics of public vs private keys, recognizing common address formats, and always matching the right coin and network, you avoid most serious mistakes. Combine that knowledge with small test transactions and simple verification habits, and using crypto addresses becomes a routine, low-stress part of your financial life.