When people talk about Ethereum, Solana, or Polygon, they are talking about blockchain networks—shared computers made of many independent nodes that agree on the same history of transactions. Instead of one company owning the database, thousands of machines around the world store and update a common ledger. These networks are where crypto assets move, smart contracts run, and decentralized apps (dApps) live. They decide how fast your transaction confirms, how much you pay in fees, and how secure your assets are. In this article, you’ll learn what a blockchain network actually is, the core pieces that make it work, and how a transaction flows from your wallet to the chain. We’ll also compare Ethereum, Solana, and other major networks, look at real use cases, and give you a safe path to try your first network in practice.

Quick Summary: What Is a Blockchain Network?

Summary

- A blockchain network is shared infrastructure where many nodes store and update the same transaction history.

- Ethereum, Solana, BNB Chain, and Polygon are examples of separate networks with their own rules and native tokens.

- Networks use consensus mechanisms so independent nodes can agree on which transactions are valid.

- Smart-contract networks let developers deploy code that runs on-chain and powers dApps, DeFi, NFTs, and more.

- Different networks make trade-offs between decentralization, security, speed, and transaction fees.

- You can usually access a network with a wallet app, without running your own node or managing servers.

From the Internet to Blockchain Networks: A Simple Analogy

Core Building Blocks of a Blockchain Network

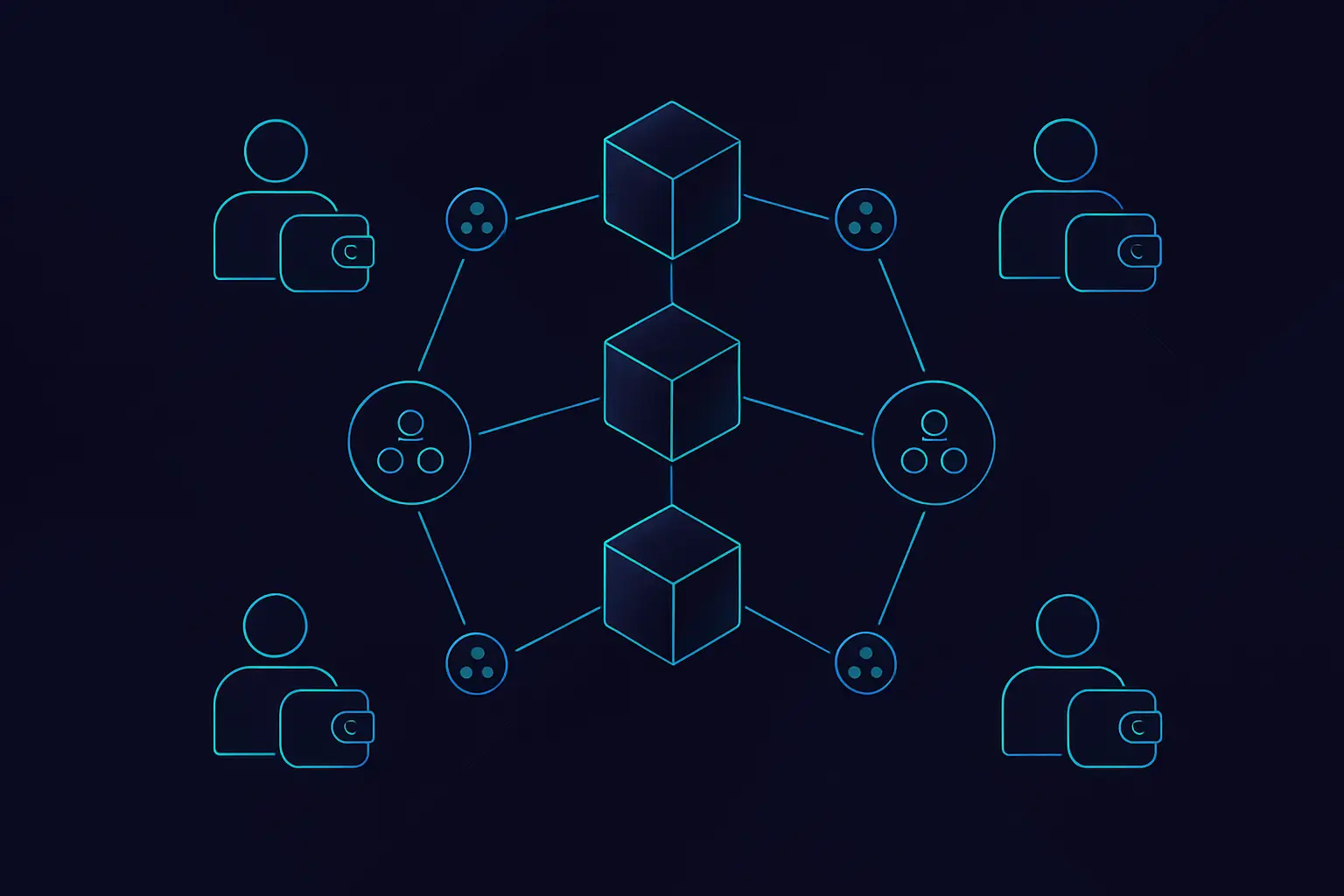

- Nodes and validators: Computers that run the network’s software, store the ledger, and relay transactions; validators propose and validate new blocks.

- Blocks and ledger: Transactions are grouped into blocks, which are linked together to form an ordered, tamper-resistant history known as the blockchain.

- Consensus mechanism: The rules (like proof-of-stake or proof-of-work) that let nodes agree on which blocks are valid and in what order.

- Network protocol: The communication rules that define how nodes find each other, share transactions, and stay in sync.

- Native token: The main asset of the network (ETH on Ethereum, SOL on Solana) used to pay fees and often to secure the chain via staking.

- Smart contracts: On programmable chains, pieces of code deployed on-chain that automatically run logic for DeFi, NFTs, games, and more.

- Clients and wallets: Software that lets users and developers interact with the network, sign transactions, and view balances without running a full node.

Pro Tip:A network is the infrastructure and rules; a token is just one asset that lives on top of it. For example, Ethereum is the network, ETH is its native token, and thousands of other tokens (like USDC) also live on the same Ethereum network.

How a Blockchain Network Works Step by Step

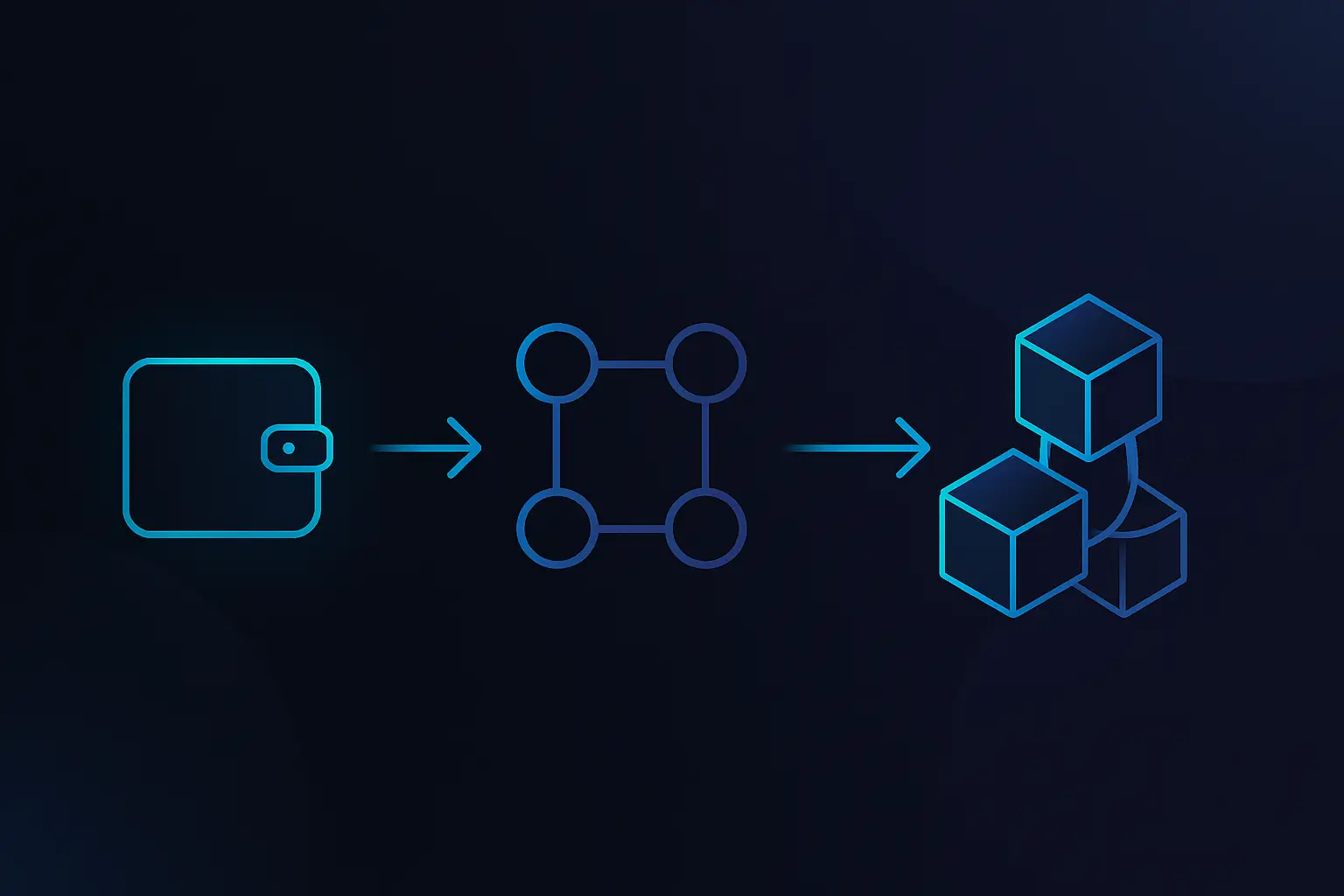

- You create a transaction in your wallet, such as sending tokens, swapping on a DEX, or minting an NFT, and specify the network and recipient or contract.

- Your wallet builds a transaction message and you sign it with your private key, proving it came from you without revealing your key.

- The signed transaction is broadcast to the network, usually via a node run by your wallet provider or a public RPC endpoint.

- Nodes receive the transaction, check basic rules (like correct signature and enough balance), and share it with other nodes in the network.

- Validators pick from the pool of pending transactions and include them in a new block, usually prioritizing those with higher fees.

- Once enough blocks have been built on top (or a finality mechanism triggers), your transaction is considered confirmed and hard to reverse.

Types of Blockchain Networks (Public, Private, Layer 1, Layer 2)

Key facts

Ethereum vs Solana vs Other Major Networks

What Can You Actually Do on a Blockchain Network?

Blockchain networks are not only about buying and selling coins on an exchange. They act as open platforms where money, code, and data can interact in new ways. Because the ledger is shared and programmable, developers can build applications that anyone can access with a wallet, without needing an account at a specific company.

Use Cases

- Send and hold crypto: Store assets like ETH, SOL, and stablecoins in a wallet and transfer them globally without traditional banks.

- Decentralized finance (DeFi): Lend, borrow, trade, and earn yield using smart contracts instead of centralized intermediaries.

- NFTs and digital collectibles: Mint, buy, sell, and prove ownership of unique digital items such as art, tickets, or in-game assets.

- Blockchain gaming: Play games where items and currencies exist on-chain, allowing trading and ownership outside the game itself.

- Stablecoin payments: Use tokens pegged to fiat currencies for faster, cheaper cross-border payments and remittances.

- DAOs and governance: Coordinate groups or projects using on-chain voting, treasuries, and transparent rules encoded in smart contracts.

- Identity and credentials: Issue and verify on-chain badges, certificates, or reputation that can be reused across different apps.

Case Study / Story

How You Interact with a Blockchain Network (User, Developer, Validator)

- End user: Uses a wallet to send tokens, interact with dApps, trade, or mint NFTs, without running any infrastructure.

- Developer: Writes smart contracts and frontends, integrates wallets, and chooses which network(s) to deploy on based on fees, tools, and audience.

- Node operator: Runs a full node that stores the entire blockchain, helps relay transactions, and can provide reliable access for apps or organizations.

- Validator / staker: Stakes tokens and participates in consensus to produce and validate blocks, earning rewards but also taking on technical and economic risk.

- Governance participant: Uses tokens or delegated voting power to influence protocol upgrades, parameter changes, or treasury spending.

- Liquidity provider: Deposits tokens into DeFi protocols or exchanges to enable trading and lending, earning fees but also facing smart contract and market risks.

Pro Tip:You can start as a simple user with a small amount of funds and a well-known wallet, without touching servers or code. If your curiosity grows, you can gradually explore smart contract tutorials, testnets, or even running a node—without ever rushing into high-risk setups.

Risks and Security Considerations of Blockchain Networks

Primary Risk Factors

Not every blockchain network is equally secure or battle-tested. Some have years of uptime and thousands of validators; others are new, lightly audited, or controlled by a small group. Because your assets and apps depend on the network’s security model, it is important to understand the main types of risks before moving large amounts of value.

Primary Risk Factors

Security Best Practices

Benefits and Limitations of Blockchain Networks

Pros

Cons

Getting Started Safely with Your First Blockchain Network

- Install a reputable wallet (browser extension or mobile) that supports your chosen network and follow its official setup guide.

- Write down your seed phrase offline, store it securely, and never share it with anyone or type it into unknown websites.

- Acquire a very small amount of funds through a trusted exchange or faucet, just enough to cover basic test transactions.

- Try simple actions like sending a tiny transfer to another wallet you control or doing a small swap on a well-known dApp.

- If available, explore the network’s testnet to practice deploying contracts or interacting with more complex apps using free test tokens.

Blockchain Network FAQ

Putting It All Together

May Be Suitable For

May Not Be Suitable For

- Traders only interested in short-term price moves

- Readers looking for tax or legal advice

- Anyone expecting guaranteed returns from specific networks

- People who need deep protocol engineering details

A blockchain network is shared infrastructure where many independent nodes maintain a common ledger and run on-chain code. Names like Ethereum, Solana, and Polygon refer to different versions of this idea, each with its own rules, performance profile, and native token. Multiple networks exist because there is no perfect design: every chain balances security, decentralization, speed, and cost in its own way. As a user or builder, your job is not to find the one true winner, but to understand these trade-offs well enough to pick a network that fits your use case and risk level. If you keep this mental model in mind and practice on testnets first, you can explore new networks with curiosity instead of confusion or fear.