A smart contract is a small program stored on a blockchain that automatically runs when certain conditions are met. Instead of a person checking an agreement and pressing buttons, the code itself enforces the rules and moves digital assets. Smart contracts power many things you hear about in crypto, like DeFi protocols, NFT marketplaces, and on-chain games. They help strangers all over the world interact and trade without needing to trust a single company or middleman. In this guide, you will see what smart contracts are, how they work behind the scenes, and where they are used today. You will also learn about their risks, what they cannot do, and how to interact with them safely as a beginner.

Smart Contract Snapshot

Summary

- Smart contracts are code on a blockchain that automatically runs when predefined conditions are met.

- They can hold and move crypto, manage NFTs, and power DeFi apps like lending, trading, and staking.

- Popular platforms for smart contracts include Ethereum, BNB Chain, Solana, Polygon, and many others.

- Benefits include automation, global access, transparency, and reduced reliance on centralized intermediaries.

- Key risks include coding bugs, hacks, permanent mistakes on-chain, and uncertain legal enforceability in some places.

- Most users interact with smart contracts through wallets and dapps, not by writing or reading the code directly.

Core Definition: What Exactly Is a Smart Contract?

- Automatic execution of rules once conditions in the code are met, without manual approval.

- Runs on a blockchain, so its logic and key data are transparent and publicly verifiable.

- Typically immutable after deployment, meaning the code cannot easily be changed or undone.

- Relies completely on correct coding and assumptions; if the logic is wrong, the blockchain will still follow it.

- Can hold and control digital assets directly, making it a powerful building block for dapps and protocols.

Why Smart Contracts Matter

Pro Tip:In crypto, people say smart contracts are trustless, but that does not mean risk-free. You are still trusting the code, the developers who wrote it, and the blockchain network that runs it. Always remember: removing human middlemen replaces some risks with new technical ones, so you should still research carefully and start small.

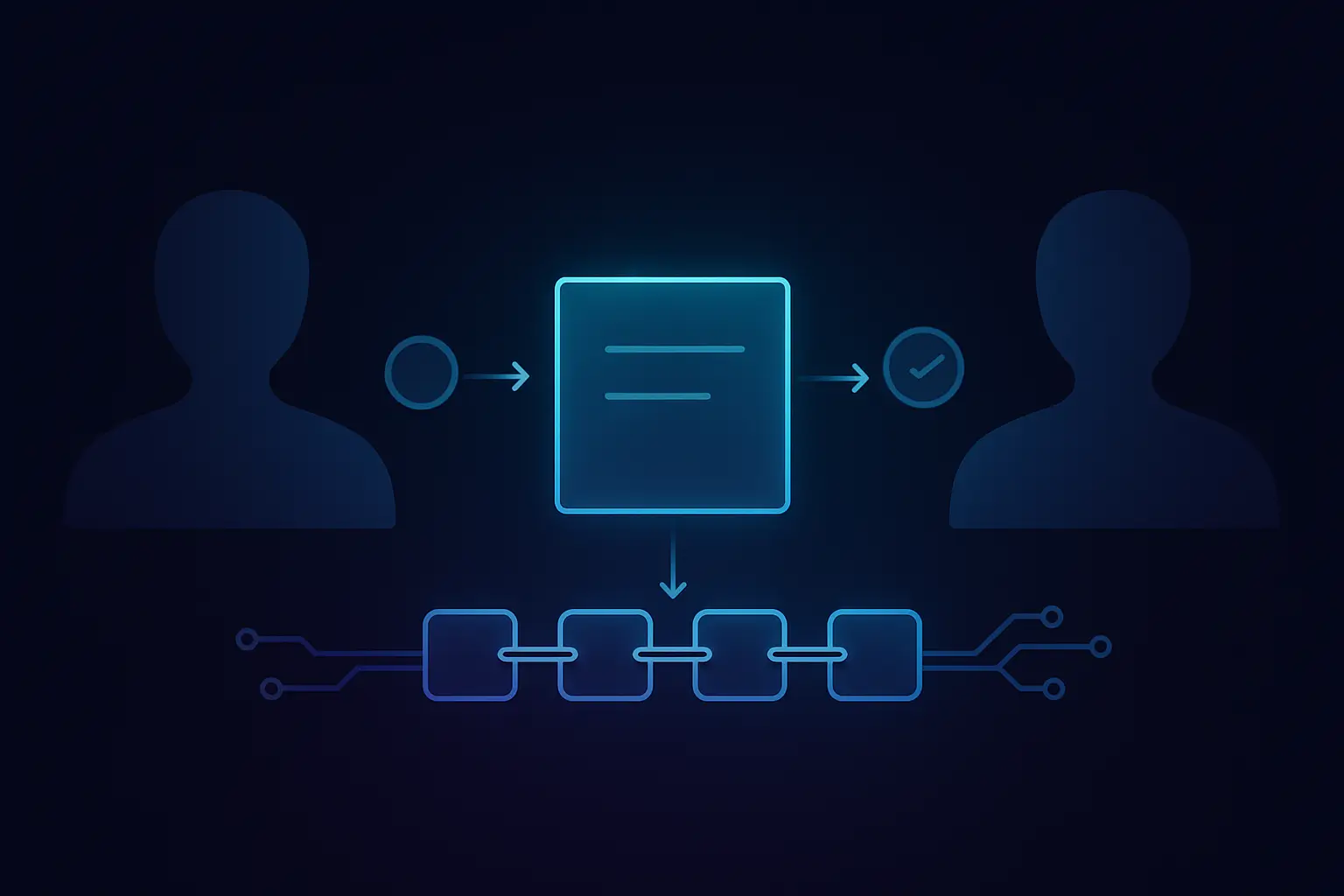

How Smart Contracts Work Under the Hood

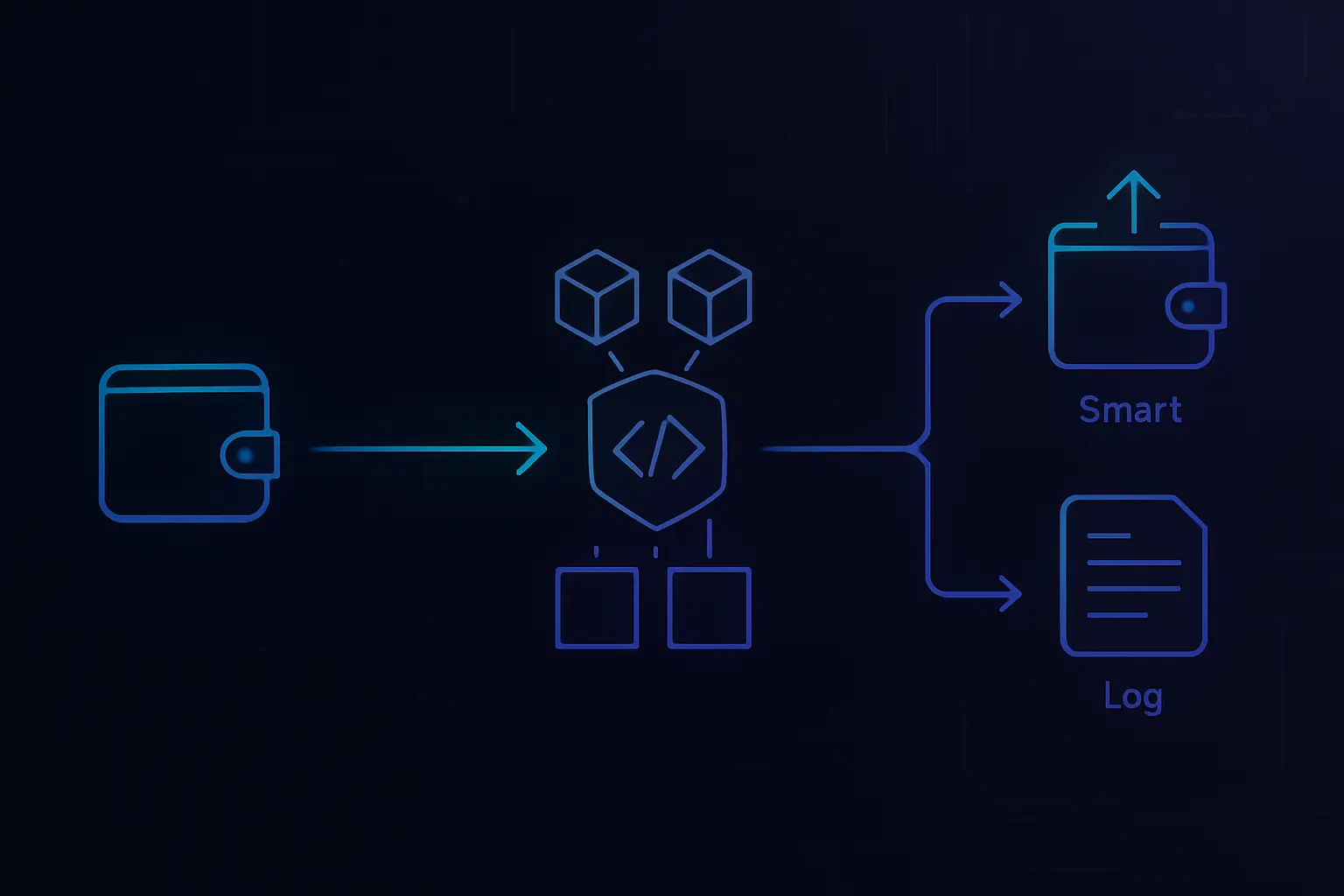

- Developers write the smart contract code in a language like Solidity or Rust and test it on local or test networks.

- They deploy the compiled contract to a blockchain, which creates a unique contract address and stores the code on-chain.

- The contract may be funded with crypto or tokens so it can hold collateral, pay rewards, or manage pooled assets.

- Users (or other contracts) send transactions that call specific functions, passing inputs such as amounts, addresses, or choices.

- Nodes on the network execute the code, update the contract’s state (its stored data), and emit events or logs for apps to read.

- The entire interaction, including inputs and outputs, becomes part of the blockchain’s permanent transaction history.

Key Building Blocks of a Smart Contract

Key facts

Where Did Smart Contracts Come From?

The idea of smart contracts is older than today’s blockchains. In the 1990s, cryptographer Nick Szabo described digital contracts that could automatically enforce rules using computer code. Bitcoin later introduced a limited scripting system that allowed simple conditions, like multi-signature wallets and time locks. But it was the launch of Ethereum in 2015 that made general-purpose smart contracts practical and widely accessible.

Key Points

- 1990s: Nick Szabo proposes the concept of smart contracts as self-executing digital agreements.

- 2009–2013: Bitcoin demonstrates programmable money with basic scripts for multisig, escrows, and time-locked transactions.

- 2015: Ethereum launches with a Turing-complete virtual machine, enabling rich smart contracts and decentralized applications.

- 2018–2020: DeFi protocols and decentralized exchanges explode in popularity, showing what composable smart contracts can do.

- 2020–2021: NFTs and on-chain gaming bring smart contracts to artists, gamers, and mainstream audiences.

- Today: Many chains, including BNB Chain, Solana, Polygon, and others, support smart contracts with different trade-offs in speed, cost, and security.

Real-World Use Cases of Smart Contracts

If you have used a DeFi app, traded an NFT, or voted in a DAO, you have probably interacted with smart contracts already. They run quietly in the background, enforcing rules and moving assets when you click buttons in a dapp. Seeing concrete use cases makes the idea less abstract. Below are some of the most common ways smart contracts are used in the real world today.

Use Cases

- DeFi lending and borrowing platforms that pool user deposits and automatically calculate interest and collateral requirements.

- Decentralized exchanges (DEXs) where smart contracts manage liquidity pools, pricing formulas, and trade settlement without a central order book.

- NFT minting, trading, and royalty payments that send a share of each resale directly to the creator’s wallet.

- Token vesting and payroll contracts that release tokens over time to team members, investors, or contributors based on predefined schedules.

- DAO governance systems where token holders vote on proposals, and smart contracts automatically execute approved decisions.

- Supply-chain tracking where each step of a product’s journey is recorded on-chain, improving transparency and auditability.

- Blockchain-based games where in-game items and currencies are controlled by smart contracts, giving players verifiable ownership.

Case Study / Story

Risks, Limits, and Security Concerns

Primary Risk Factors

Smart contracts remove some traditional risks, such as trusting a single company not to freeze your account or change the rules overnight. But they introduce new risks that are just as serious, especially for beginners. Because smart contracts are immutable, a bug in the code can lock or misdirect funds permanently. Many contracts also depend on external data feeds, called oracles, which can fail or be manipulated. On top of that, the legal status of some smart-contract-based arrangements is still evolving. In many places, it is not yet clear how courts will treat disputes that involve on-chain code and off-chain promises.

Primary Risk Factors

Security Best Practices

- Favor audited and long-running protocols, start with small amounts, and double-check every transaction you sign. Remember that on most blockchains there is no support desk to undo a mistake.

Smart Contracts: Advantages and Drawbacks

Pros

Cons

Smart Contracts vs. Traditional Contracts and Apps

Getting Started: Interacting With Smart Contracts Safely

- Install a reputable wallet from the official website or app store, and securely back up your seed phrase offline.

- Start on testnets or with very small amounts of real funds until you are comfortable with how transactions and gas fees work.

- Access dapps only via official links or trusted aggregators, and double-check the URL to avoid phishing sites.

- Verify the smart contract address from multiple sources, such as project docs, official announcements, and block explorers.

- Read basic documentation or FAQs to understand what the contract does and what risks are involved before using it.

- Carefully review the permissions you grant when approving tokens, and avoid giving unlimited access unless truly necessary.

Smart Contracts FAQ

Final Thoughts: How to Think About Smart Contracts

May Be Suitable For

May Not Be Suitable For

- Anyone expecting risk-free, guaranteed returns from smart contracts

- Users uncomfortable managing their own keys and security

- Situations that rely heavily on human judgment or complex legal nuance

- People who need strong consumer protections and easy chargebacks

Smart contracts are one of the core innovations that make modern blockchains more than just payment networks. They turn code into autonomous agreements that can hold assets, enforce rules, and coordinate people across the world without a central operator. Used wisely, they enable DeFi, NFTs, DAOs, and many other experiments in open finance and digital ownership. Used carelessly, they can expose you to bugs, hacks, and irreversible mistakes. As you continue your crypto journey, treat smart contracts like powerful but unforgiving software. Learn how they work at a high level, start with simple use cases, and combine them with good security habits and, when needed, traditional legal protections.