Blockchain scalability is about how many transactions a network can handle, and how quickly, without breaking its security or decentralization. When a chain cannot scale, users feel it as high fees, slow confirmations, and failed transactions during busy periods. If you tried sending a small payment or minting an NFT during a bull run, you may have seen fees jump to several dollars and waits of many minutes. That experience makes people question whether crypto can ever support everyday payments, gaming, or mainstream DeFi. This guide walks through the core ideas behind scalability and why it is hard, including the scalability trilemma. You will learn how base-layer upgrades like sharding and off-chain solutions like rollups and other layer 2 (L2) networks work together to make blockchains faster and cheaper, and what trade-offs to watch for.

Scalability in a Nutshell

Summary

- Scalability means handling more transactions per second while keeping the network secure and responsive for users.

- It is hard because of the scalability trilemma: improving scalability often pressures security or decentralization.

- Sharding scales the layer 1 itself by splitting the blockchain into parallel shards that share security.

- Rollups and other layer 2 solutions move computation off-chain and post compressed data or proofs back to L1.

- Sharded L1s shine at increasing raw throughput, while rollups shine at flexible deployment and fast iteration.

- Most mature ecosystems are moving toward a mix of scalable L1 plus powerful L2s, each with different trade-offs.

Scalability Basics: Throughput, Latency, and the Trilemma

- Transaction fees rise sharply during busy periods, making small payments or trades uneconomical.

- The mempool stays congested, with many pending transactions waiting to be included in a block.

- Users see long or unpredictable confirmation times, especially when they use default fee settings.

- Apps or wallets start relying on centralized relays or custodial services to hide on-chain congestion from users.

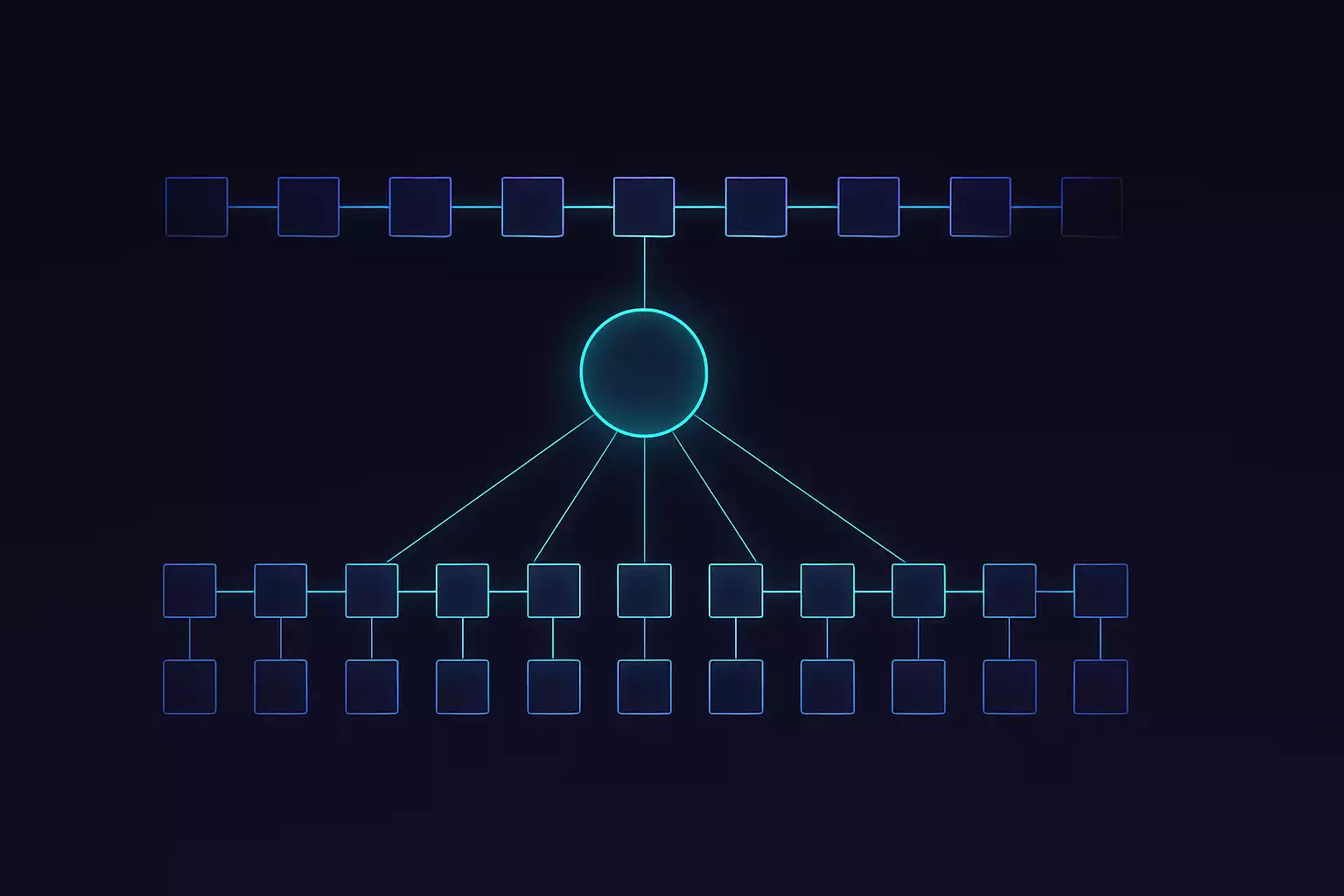

Two Paths to Scale: Layer 1 vs Layer 2

- On-chain: Bigger blocks or shorter block times increase raw capacity but can make it harder for small nodes to keep up.

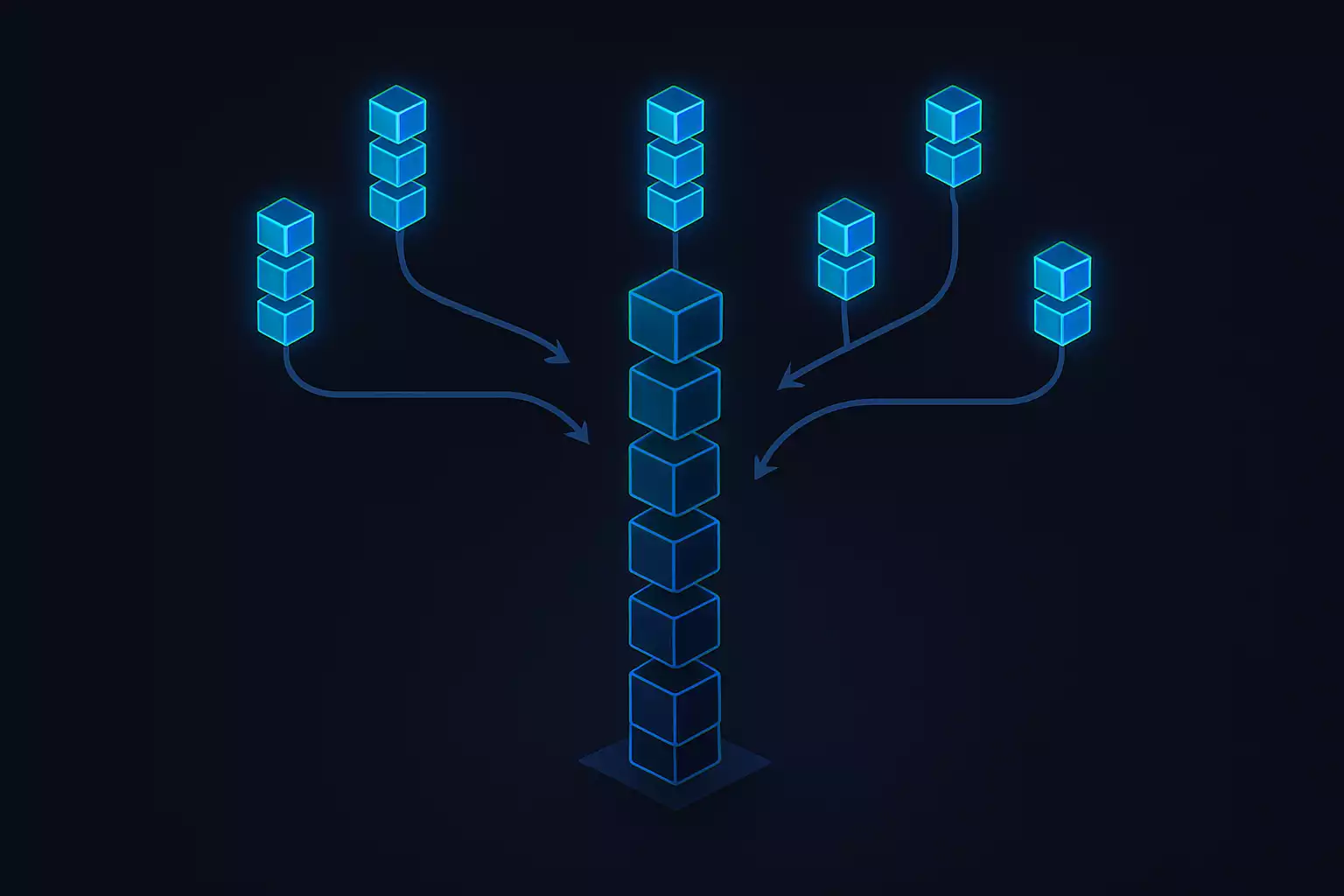

- On-chain: Sharding splits the blockchain into multiple shards that process different transactions in parallel while sharing security.

- Off-chain/L2: Rollups execute transactions off-chain and post compressed data or proofs back to the L1 for security.

- Off-chain/L2: Payment channels let two parties transact frequently off-chain and settle only the final result on L1.

- Off-chain/L2: Sidechains are separate blockchains bridged to the main chain, often with their own validators and security assumptions.

Sharding Explained: Splitting the Blockchain into Pieces

- Parallel shards can process many transactions at once, significantly increasing total network throughput.

- Because state is split across shards, individual nodes may store and process less data, lowering hardware requirements.

- Cross-shard transactions are more complex, since data and messages must move safely between different shards.

- Security must be carefully designed so that no shard becomes an easy target, often using random validator assignments and shared consensus.

- Ensuring data availability across shards is critical, so that users and light clients can still verify the overall system.

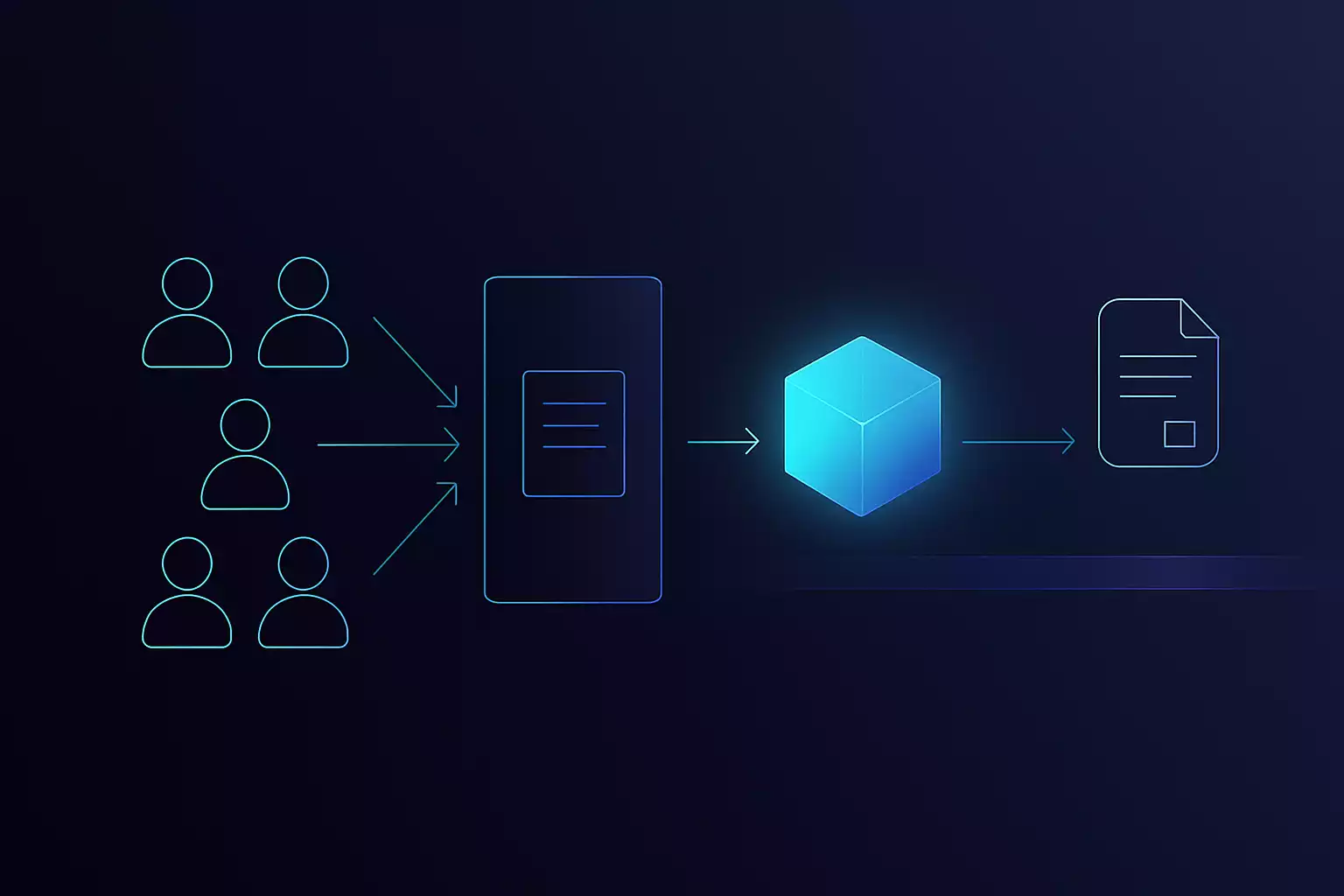

Rollups and Layer 2: Scaling by Moving Computation Off-Chain

Key facts

- Fees are lower because many user transactions are bundled into a single L1 transaction, sharing base-layer costs.

- User experience feels fast because rollups can give near-instant soft confirmations before posting batches on-chain.

- Security still depends heavily on the underlying L1 and on the rollup’s proof system, data availability, and upgrade governance.

Real-World Use Cases of Scalable Blockchains

Better scalability turns crypto from an expensive, slow settlement layer into something users can interact with every day. When fees drop and confirmations speed up, entirely new categories of applications become realistic. DeFi protocols can support smaller traders, games can move most in-game actions on-chain, and NFTs can be minted or traded in bulk. Rollups, sharded chains, and other scaling solutions are already enabling experiments that would be impossible on a congested base chain alone.

Use Cases

- Low-fee DeFi trading on rollups where users can swap tokens or provide liquidity without paying several dollars per transaction.

- Large-scale NFT minting events, such as game assets or collectibles, that would otherwise overwhelm a single L1 blockspace.

- Blockchain gaming with frequent micro-transactions for moves, upgrades, and rewards, all processed cheaply on L2.

- Cross-border payments and remittances where users send small amounts globally without losing a big share to fees.

- High-frequency arbitrage and market-making strategies that need many rapid trades, enabled by high throughput and low latency.

- Enterprise or institutional workflows, like supply-chain tracking or internal settlements, that require predictable costs and performance.

Case Study / Story

Risks, Security Considerations, and Trade-Offs

Primary Risk Factors

Scalability is powerful, but it does not come for free. Every new mechanism, whether sharding or rollups, adds complexity and new places where things can break. L2s often rely on bridges, sequencers, and upgrade keys that introduce additional trust assumptions beyond the base chain. Sharded systems must coordinate many components correctly to avoid data availability or security gaps. As a user or builder, it is important to understand not just that a network is fast and cheap, but also what assumptions and risks sit underneath those benefits.

Primary Risk Factors

Security Best Practices

Pros and Cons of Sharding vs Rollups

Pros

Cons

Future of Blockchain Scalability

Comparison: Legacy Scaling vs Crypto Scaling

How to Interact Safely with L2s and Scaled Networks

- Start with a small test transfer to the L2 to verify that deposits and withdrawals work as expected.

- Read about typical withdrawal times and any challenge periods so you are not surprised when exiting back to L1.

- Monitor network fees on both L1 and L2, since high L1 gas can still affect deposits and withdrawals.

- Use reputable wallets that clearly show which network you are on and support the L2 you plan to use.

FAQ: Blockchain Scalability, Sharding, and Rollups

Key Takeaways on Blockchain Scalability

May Be Suitable For

Blockchain scalability is about serving more users with faster, cheaper transactions while still preserving strong security and decentralization. It is difficult because of the scalability trilemma: pushing one dimension too far often strains the others. Sharding tackles the problem by upgrading the base chain itself, splitting it into multiple shards that share security and increase throughput. Rollups and other L2s move most computation off-chain and use the L1 mainly for data and settlement, unlocking big efficiency gains. For everyday users, the result should be apps that feel as smooth as web services while still offering verifiable, open infrastructure underneath. As you explore different networks, pay attention not only to speed and fees, but also to security assumptions, bridge designs, and decentralization, so you can choose the right environment for your needs.