When many people hear "crypto mining", they picture a computer quietly printing free money in the background. In reality, mining is a competitive process where machines secure a blockchain, validate transactions, and earn rewards for doing so. Instead of a central bank, proof-of-work networks like Bitcoin rely on miners to agree on which transactions are valid and in what order. Miners spend real resources – mainly electricity and hardware – to solve cryptographic puzzles, and the network rewards the winner with newly created coins and fees. In this guide, you’ll learn why mining exists, how it works step by step, what kinds of hardware are used, and where rewards actually come from. We’ll also cover risks, environmental debates, mining vs. staking, and how to decide whether mining is a serious opportunity for you or better treated as a learning experiment.

Quick Snapshot: What Crypto Mining Really Is

Summary

- Mining secures proof-of-work blockchains by making it expensive to attack or rewrite transaction history.

- Miners earn income from block rewards (new coins) plus transaction fees paid by users.

- Most profitable mining today is done by specialized operations with cheap electricity and efficient ASIC hardware.

- Main costs are electricity, hardware purchase, cooling, and sometimes hosting or facility expenses.

- Beginners usually mine as a small hobby or learning project, not as a main income stream.

- For many users, regularly buying crypto or earning it through work is simpler and less risky than starting a mining operation.

Why Mining Exists and Why It Matters

- Validate and order transactions into blocks so everyone shares the same transaction history.

- Provide security by making it costly to alter or censor the blockchain.

- Issue new coins in a predictable way, replacing the role of a central bank in creating money.

- Distribute newly created coins to miners who invest in hardware and energy, aligning incentives.

- Help the network remain decentralized by allowing many independent miners to participate.

How Crypto Mining Works Step by Step

- Users send transactions, which are checked by nodes and placed into a shared pool of pending transactions called the mempool.

- A miner selects transactions from the mempool, usually prioritizing those with higher fees, and builds a candidate block.

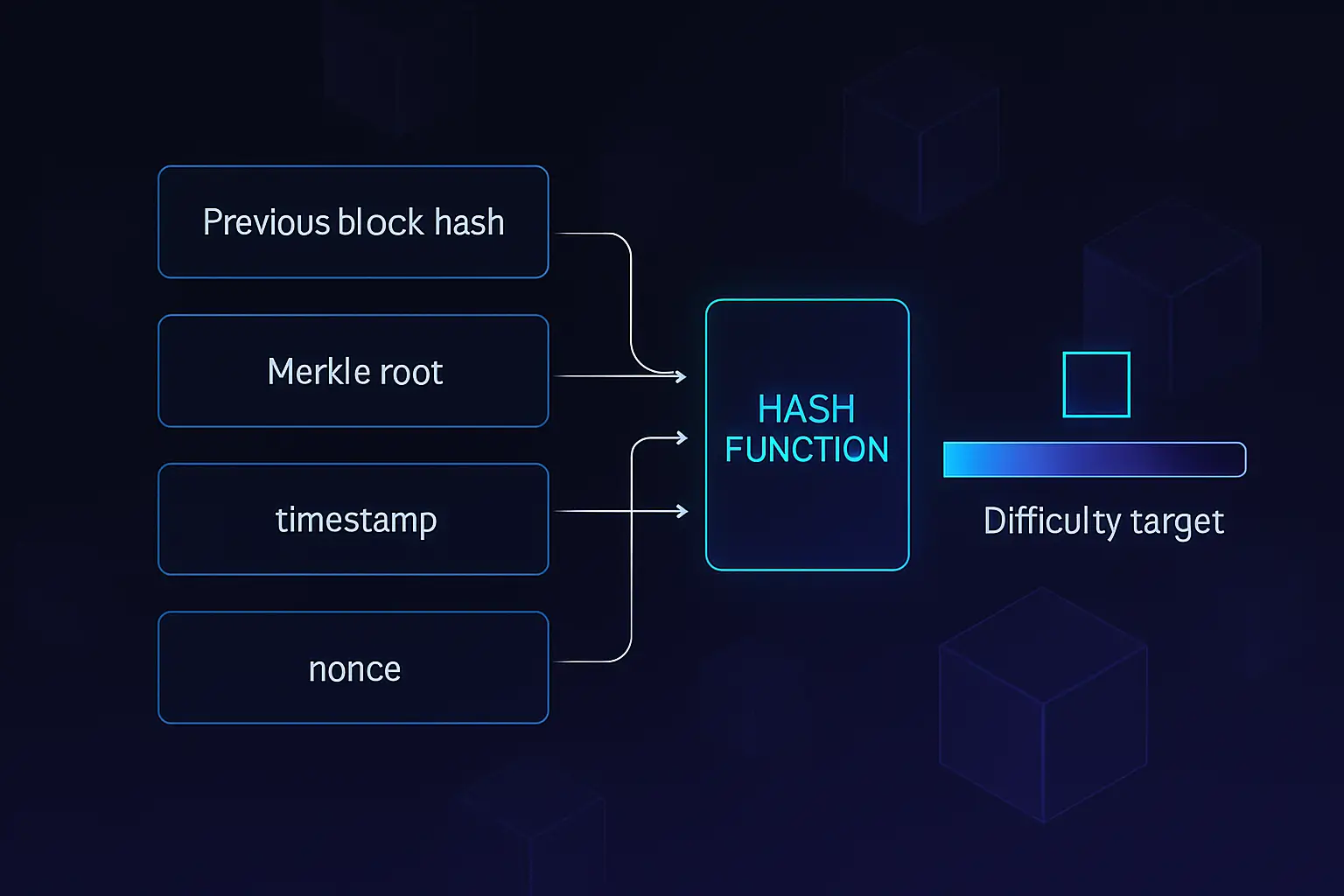

- The miner hashes the block header repeatedly, changing the nonce and other small fields, until the resulting hash meets the network’s difficulty target.

- The first miner to find a valid hash broadcasts their block to the network for verification.

- Other nodes independently verify the block’s transactions and proof-of-work; if valid, they add it to their copy of the blockchain.

- The winning miner receives the block reward and collected transaction fees, while everyone else starts working on the next block.

Mining Hardware and Typical Setups

Key facts

Mining Rewards, Halvings, and Profitability Basics

- Market price of the coin you are mining (revenue is paid in that asset).

- Current block reward size and average transaction fees per block.

- Network difficulty and total hashrate, which determine how often your hardware finds shares or blocks.

- Energy price per kWh and overall power consumption of your setup.

- Hardware efficiency, purchase price, and expected lifetime before it becomes uncompetitive.

- Pool fees, hosting fees, and other operating costs that reduce your net payout.

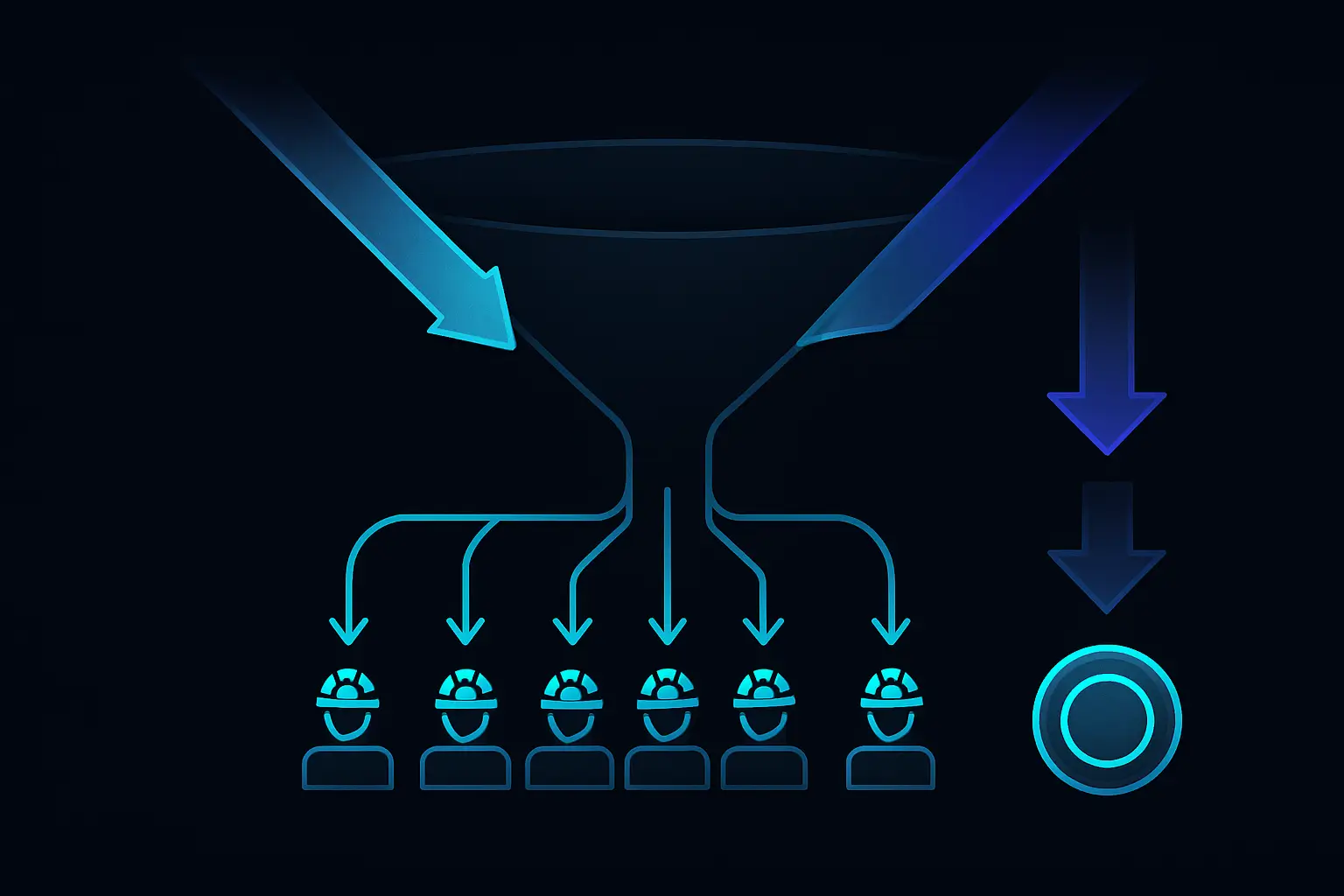

Mining Pools vs. Solo Mining

- Solo mining offers full control and no pool fees, but payouts are extremely irregular and often unrealistic for small hashrate.

- Pool mining provides more stable, predictable income by sharing rewards across many participants.

- Pools charge a small fee (often 1–3%) on rewards to cover their infrastructure and services.

- Large pools can become a centralization risk if they control a big share of network hashrate.

- Solo miners must run full node infrastructure and handle all configuration themselves, while pools simplify setup with easier software and dashboards.

Case Study / Story

Who Actually Mines and Why

Today, most hashrate on large proof-of-work networks comes from specialized mining farms with thousands of ASICs and access to cheap power. These operations treat mining like a full-scale industrial business with professional cooling, maintenance, and risk management. Hobbyists and small miners still exist, but they usually operate in niches: regions with surplus or very cheap electricity, smaller PoW coins, or educational setups. Even if you never mine, you benefit from these participants because they help keep the network secure and decentralized.

Use Cases

- Large industrial farms colocated near hydro, wind, or gas power plants to minimize electricity costs.

- Small GPU hobby miners who treat mining as a technical hobby and a way to accumulate small amounts of crypto over time.

- Operations in regions with surplus or stranded energy, such as remote hydro stations or flared natural gas sites.

- Multi-coin GPU miners who switch between different proof-of-work coins based on short-term profitability.

- Educational setups in universities or at home, used to teach how blockchains and consensus work in practice.

- Experimental eco-friendly mining projects using only renewable energy or capturing waste heat for heating buildings.

- Miners focusing on niche PoW blockchains where their hashrate significantly contributes to network security.

Energy Use, Environment, and Regulation

- Public debate focuses on mining’s energy use and associated greenhouse gas emissions, especially in coal-heavy grids.

- Some miners are moving toward renewables or using otherwise wasted energy to reduce both costs and environmental impact.

- Several countries and regions have restricted or banned large-scale mining due to energy strain or environmental concerns.

- Regulatory pressure has pushed miners to relocate across borders, reshaping where hashrate is concentrated globally.

- Major projects like Ethereum have migrated from proof-of-work to proof-of-stake to reduce energy consumption.

Risks, Security, and Common Pitfalls in Mining

Primary Risk Factors

Mining may look like a straightforward way to earn crypto, but it carries real financial, technical, and security risks. Individuals can lose money on hardware, face rising electricity bills, or fall for fraudulent cloud-mining schemes. At the network level, mining also shapes security. Concentration of hashrate in a few pools or regions can increase the risk of censorship or a 51% attack, where an attacker controls a majority of mining power and can manipulate recent transactions.

Primary Risk Factors

Security Best Practices

- Start with a small, low-cost setup or even a mining simulator, and track real-world earnings and expenses for a few months before committing serious capital.

Mining vs. Staking and Other Consensus Methods

- PoW mining costs are dominated by hardware and electricity; PoS costs are dominated by the capital you lock as stake.

- PoW has a larger energy footprint, while PoS is more energy-efficient but concentrates influence in large holders.

- In PoW, an attacker needs massive hashrate; in PoS, they need a large share of the total staked coins.

- Small users may find it easier to join PoS via staking pools or exchanges than to run competitive mining hardware.

- Bitcoin and Litecoin are major PoW coins; Ethereum, Cardano, and Solana use proof-of-stake or similar systems.

Home Mining vs. Industrial Mining at a Glance

Common Beginner Mistakes in Crypto Mining

- Not calculating total cost of ownership, including hardware, electricity, cooling, and potential repairs over the device’s lifetime.

- Ignoring heat and noise, then discovering that mining rigs make rooms uncomfortably hot and loud.

- Trusting unverified cloud mining offers that promise high returns with no risk or clear business model.

- Failing to secure mined coins by leaving them on pool or exchange wallets instead of using safe self-custody options.

- Running hardware 24/7 without monitoring temperatures, leading to premature failure or even safety hazards.

- Misunderstanding tax or reporting obligations on mined coins in their country, which can create problems later.

- Assuming past profitability charts will repeat, instead of stress-testing numbers against lower prices and higher difficulty.

FAQ: Crypto Mining for Beginners

Should You Get Into Crypto Mining?

May Be Suitable For

- Technically inclined users with access to cheap, reliable electricity

- Hobbyists who want to understand proof-of-work and are comfortable with small or zero profits

- People who already own suitable GPUs and want to experiment safely

- Learners who value hands-on experience more than short-term returns

May Not Be Suitable For

- Anyone expecting guaranteed passive income or quick profits

- People with high electricity prices or strict housing rules about noise and heat

- Users who are not willing to monitor hardware, safety, and taxes

- Investors who simply want price exposure and have no interest in running equipment

Miners are the backbone of proof-of-work blockchains, turning electricity and hardware into security, transaction validation, and predictable coin issuance. Without them, networks like Bitcoin could not function in a decentralized, trust-minimized way. However, modern mining is a competitive industry dominated by players with cheap power, efficient ASICs, and professional operations. For most individuals, especially with average or high electricity prices, mining is unlikely to be a reliable profit engine. If you have a strong technical interest, access to low-cost energy, or spare hardware, a small mining setup can be a valuable learning tool. If your main goal is financial exposure to crypto, regularly buying, earning, or staking coins is usually simpler and less risky than trying to build a mining business from scratch.