Gas fees are the price you pay to use a blockchain, similar to paying a small toll every time you cross a bridge. They are charged when you send crypto, swap tokens, mint NFTs, or interact with DeFi apps because the network is doing work for you. For many people, these fees feel random, especially when a simple transfer suddenly costs more than the amount being sent. During busy times, gas fees can jump sharply, and wallets often show confusing terms like gas price, gas limit, and “max fee.” In this guide, you will learn what gas fees actually are, who receives them, and how they are calculated behind the scenes. We will also look at why gas fees go up and down, how different networks compare, and practical ways to reduce what you pay without getting your transactions stuck.

Quick Answer: What Are Gas Fees?

Summary

- Gas is a unit that measures how much computing work and storage a transaction needs on a blockchain.

- Gas fees are paid in the network’s native token (for example, ETH on Ethereum).

- Most of the fee goes to miners or validators, and on some networks a portion is also burned (destroyed).

- The size of the fee depends on network congestion, transaction complexity, and gas price chosen by users.

- Each blockchain has its own fee model, but all are based on paying for limited blockspace and computation.

- Wallets often let you choose between faster but more expensive confirmation and slower but cheaper options.

Gas Fees in Everyday Terms

Pro Tip:Paying a higher gas fee usually means your transaction is picked up and confirmed more quickly. For small amounts or non-urgent actions, it often makes more sense to choose a slower, cheaper option or wait for a less busy time. Always compare the fee size to the value of the transaction before you confirm.

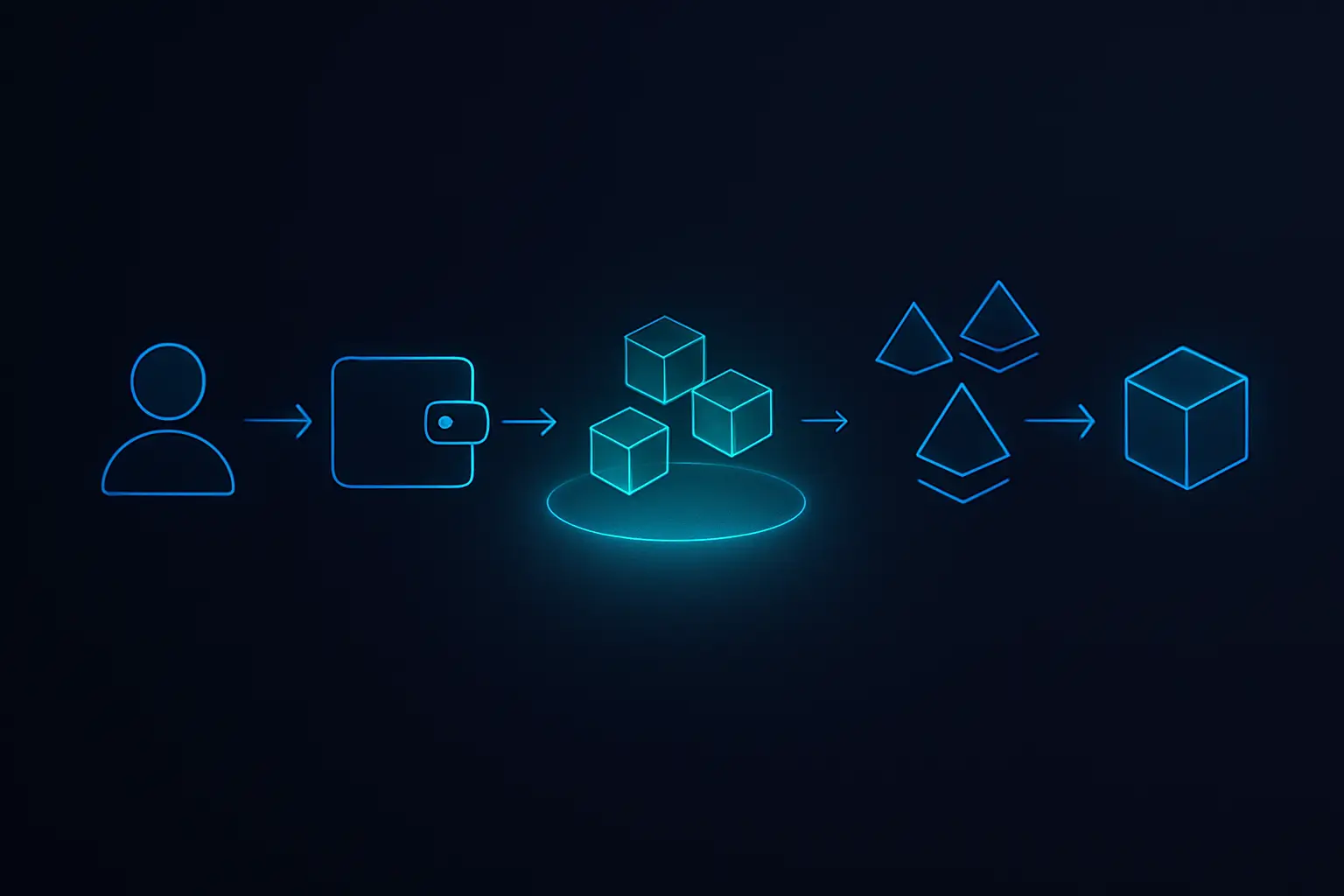

How Gas Fees Actually Work on a Blockchain

- On proof-of-work networks, most gas fees go to miners who include transactions in blocks.

- On proof-of-stake networks, gas fees usually go to validators and sometimes to delegators who stake with them.

- Some networks (like Ethereum after EIP-1559) burn a base portion of the fee, permanently removing it from supply.

- The remaining part of the fee, such as tips or priority fees, goes directly to the block producer as extra reward.

- These rewards give miners or validators a strong economic reason to secure and maintain the network.

Gas Price, Gas Limit, and Total Fee Explained

Key facts

What Makes Gas Fees Go Up or Down?

- Overall network congestion: more pending transactions in the mempool usually mean higher gas prices.

- Transaction complexity: interacting with complex smart contracts or DeFi protocols uses more gas than a simple transfer.

- Popular events: NFT mints, airdrops, or market crashes can trigger sudden spikes in demand and fees.

- Layer-1 vs. layer-2: mainnets often have higher fees, while rollups and sidechains are usually cheaper but with different trade-offs.

- Base fee rules: some protocols automatically raise or lower a base fee per gas depending on recent block usage.

- Native token price: when the network’s token rises in fiat value, the same gas amount can become more expensive in dollars.

Pro Tip:Before sending a non-urgent transaction, quickly check current average gas fees on a block explorer or in your wallet’s fee suggestions. If the network is busy and prices look high, consider waiting for a quieter time or using a cheaper network instead of forcing your transaction through at any cost.

Common Actions That Require Gas Fees

Almost every action that touches a blockchain directly will cost some gas. You are paying for the network to record your transaction permanently and, if needed, to run smart contract code on your behalf. Some actions are light and cheap, while others are heavy and expensive. Understanding which activities consume more gas helps you plan your on-chain behavior and avoid surprises when fees spike.

Use Cases

- Sending tokens between wallets on the same network, such as transferring ETH or stablecoins to a friend.

- Swapping tokens on decentralized exchanges (DEXs), which call smart contracts to execute trades.

- Adding or removing liquidity in DeFi pools, often involving multiple token transfers and contract interactions.

- Minting, buying, or transferring NFTs, which can be more gas-intensive than simple token transfers.

- Deploying new smart contracts, a heavy operation that typically requires a large gas limit and higher total fee.

- Interacting with lending, borrowing, or yield farming protocols that run complex on-chain logic.

- Bridging assets between different blockchains or layers, which may involve multiple transactions and security checks.

Case Study: Learning to Stop Overpaying for Gas

How to Pay Less in Gas (Without Getting Stuck)

- Check typical gas levels over a day and prefer off-peak hours when the network is less congested.

- Use layer-2 networks or lower-fee chains for routine swaps, small payments, or frequent DeFi interactions when possible.

- Batch actions when it makes sense, such as moving funds once instead of many small transfers over time.

- Avoid unnecessary approvals and repeated contract interactions; only approve the amount of tokens you actually need.

- Let trusted wallets suggest a gas limit unless you know what you are doing, and avoid setting it unrealistically low.

- Learn how your wallet’s “slow,” “normal,” and “fast” fee presets work, and pick the cheapest option that still meets your timing needs.

- Before big or complex actions, simulate or preview the transaction in a reputable tool to estimate gas costs in advance.

Risks and Mistakes Related to Gas Fees

Primary Risk Factors

Gas fees themselves are not a scam; they are a built-in part of how blockchains function. The risk comes from misunderstanding how they work or from trusting tools that promise unrealistic savings. If you are not careful, you can overpay during busy periods, lose money on failed transactions, or sign malicious contracts that drain your wallet under the cover of “gas optimization.” Knowing the main pitfalls helps you spot red flags before you click confirm.