Crypto taxes don't have to be intimidating. In the UK, cryptocurrency is treated as property, meaning most disposals (selling, swapping, or spending) are subject to Capital Gains Tax (CGT) — not income tax. This guide breaks down everything you need to know about reporting crypto gains, staking rewards, and losses in plain English.

It is not financial or tax advice, but a practical starting point for UK investors who want to stay compliant and avoid HMRC surprises.

Quick Overview

UK Crypto Tax Essentials

- UK investors face two main types of tax on crypto: Capital Gains Tax (CGT) and Income Tax.

- CGT applies when you sell crypto for GBP, swap coins, or use crypto for payments. Annual allowance: £3,000 (2025). Rates: 10% or 20%.

- Income Tax applies to staking rewards, mining payouts, and airdrops at market value in GBP when received.

- HMRC requires detailed records of every crypto transaction in GBP for up to 5 years.

How Crypto is Taxed in the UK

Capital Gains Tax (CGT)

You pay CGT when you sell crypto for GBP, swap one coin for another (e.g. ETH → BTC), or use crypto to pay for goods and services. In 2025, the annual CGT allowance is £3,000 — gains below this amount are tax-free. Rates are 10% or 20% depending on your total income.

Income Tax

Crypto you receive as staking rewards, mining payouts, or airdrops may be treated as income at the market value in GBP at the time of receipt. Subsequent sales are then subject to CGT on any additional gains.

HMRC Record-Keeping Rules

You must track the GBP value of every crypto transaction at the time it happens. HMRC uses this data to calculate gains/losses and expects accurate records for up to 5 years.

Capital Gains Tax Explained

Understanding Capital Gains Tax (CGT) is crucial for any UK crypto investor. HMRC treats most crypto disposals as taxable events — meaning you owe tax not just when you "cash out," but also when you swap coins or spend crypto.

What Triggers CGT Events?

CGT applies in several common scenarios:

- Selling crypto for GBP: e.g. converting ETH to pounds on Kraken.

- Swapping crypto for crypto: exchanging ETH → BTC is a disposal of ETH and an acquisition of BTC.

- Using crypto for purchases: paying for goods, services, or NFTs is considered a disposal.

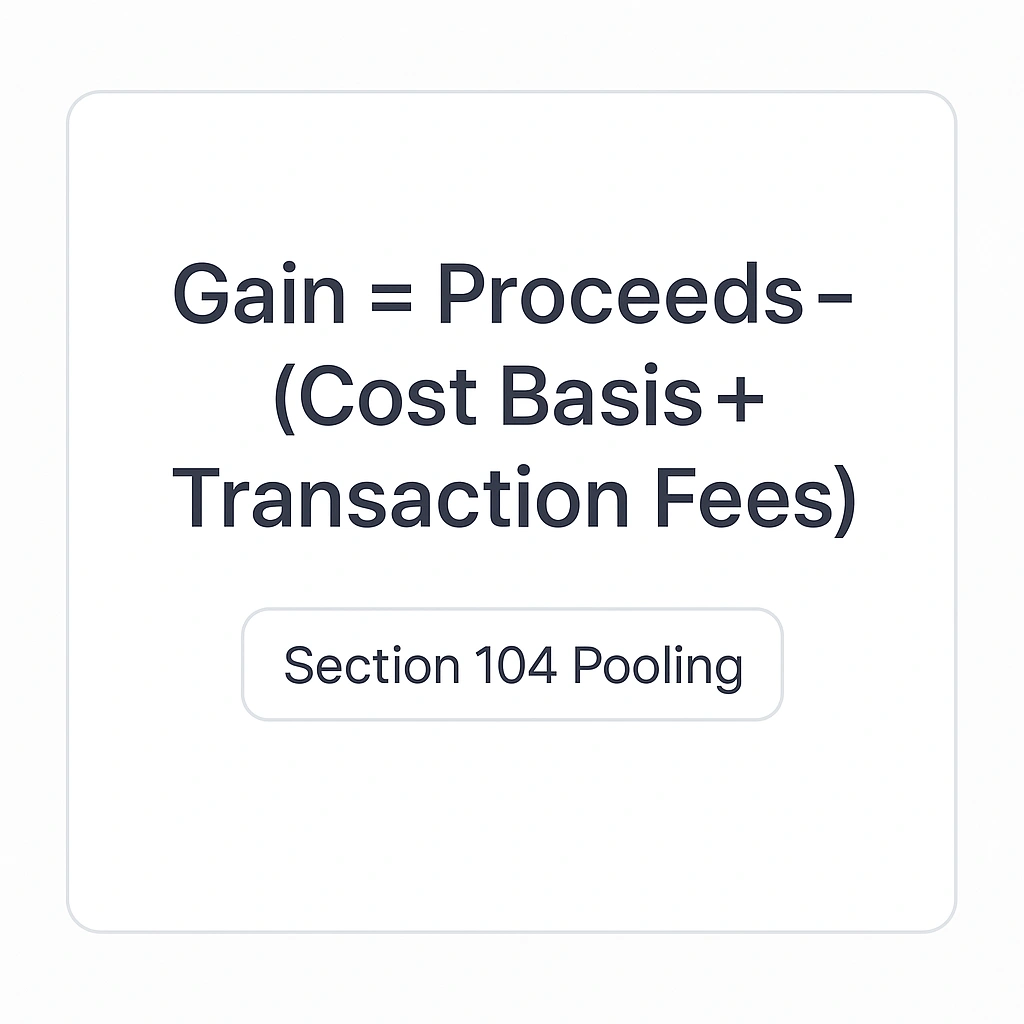

How to Calculate Gains

HMRC uses this formula:

Where:

- Proceeds = GBP value received when selling or swapping

- Cost Basis = your average purchase price (per HMRC's Section 104 pooling rules)

- Fees = exchange fees or gas costs you can add to cost basis

Pooling means you calculate an average cost basis for all identical assets you hold — similar to share dealing rules.

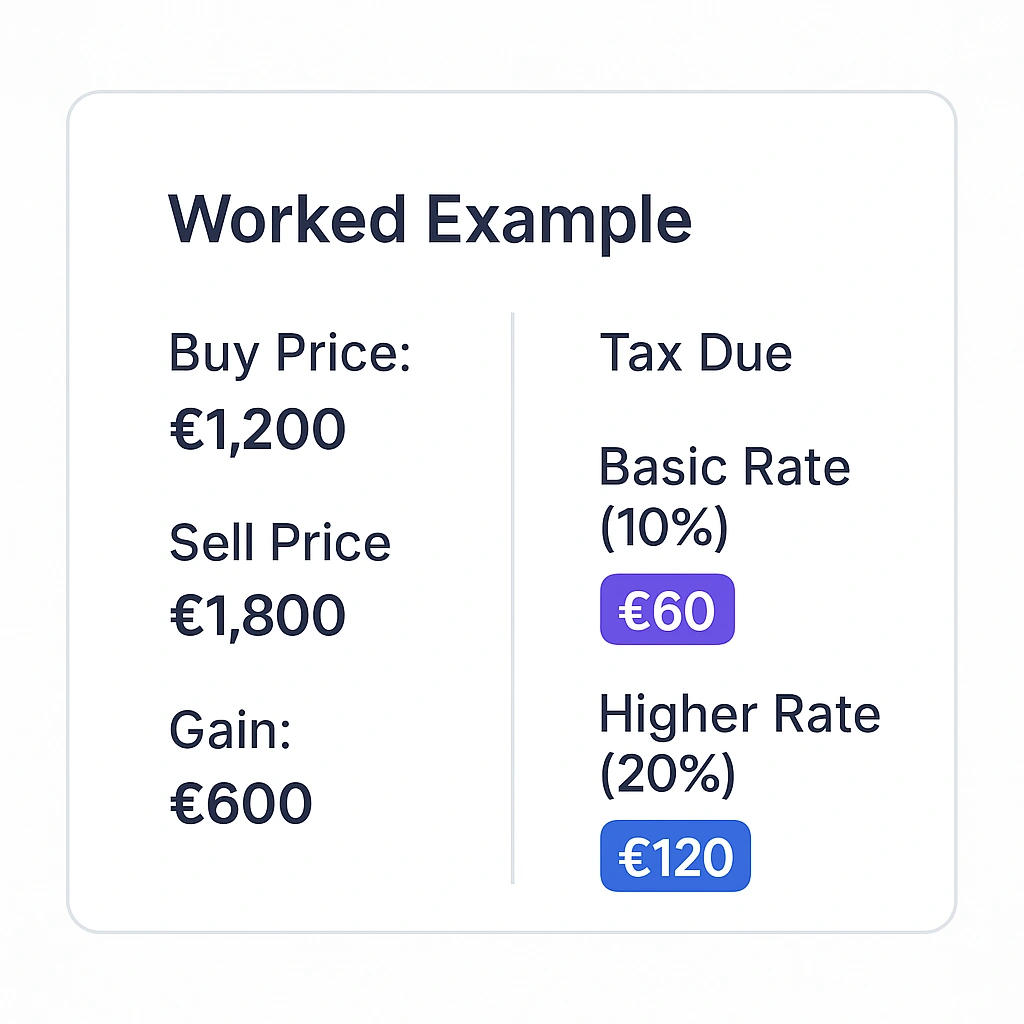

Example Calculation

Scenario: You bought 1 ETH in January for £1,200 and sold it in March for £1,800.

CGT Calculation Example

If your annual gains exceed the £3,000 CGT allowance (2025), here's what you'd pay:

Tax Due by Rate

Pro Tip: Keep detailed records of purchase dates and prices. HMRC's Section 104 pooling rules can make calculations complex for frequent traders.

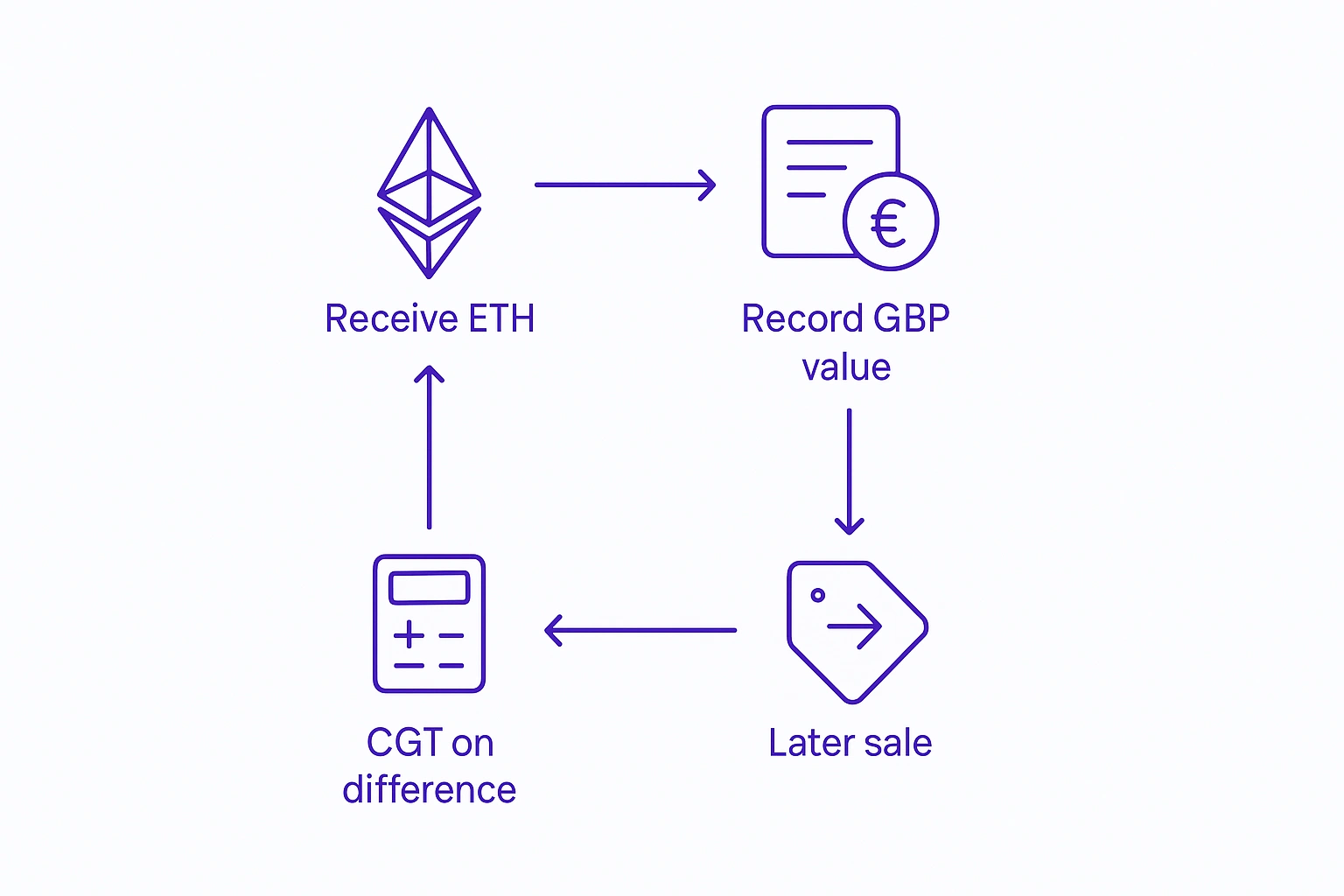

Income Tax on Staking, Mining & Airdrops

Not all crypto is taxed under Capital Gains rules — in some cases, HMRC treats it as income when you receive it. This is especially relevant for ETH staking rewards, which are becoming a major source of yield for UK investors.

Staking Rewards

Any ETH you earn through staking (either directly running a validator or using Kraken's staking product) is taxed as income at the moment you receive it. The GBP value on that day is what you must report. When you later sell that ETH, you'll also pay CGT on any price change since you received it.

Mining Rewards

If you mine crypto:

- Hobby miners are taxed on the GBP value of coins mined as miscellaneous income.

- Professional miners may have to register as a business and pay Income Tax + National Insurance contributions on profits after expenses.

Airdrops

HMRC distinguishes between free promotional airdrops and those tied to an action (e.g. tweeting, signing up).

- Genuine gift: may not be taxable until sold.

- Reward for action: treated as income at GBP value when received.

Key Difference: Income vs CGT

Income Tax vs Capital Gains Tax Comparison

Pro Tip: Keep detailed records of staking rewards — date, time, GBP value. Tools like Koinly or CoinTracking automatically convert to GBP and prepare HMRC reports.

Record-Keeping & Tools

Good record-keeping is the backbone of stress-free crypto taxes in the UK. HMRC requires you to keep detailed transaction records for at least 5 years after the end of the tax year. If you can't produce them, you may face penalties or estimated assessments.

What to Track

For every buy, sell, swap, or staking reward, record:

- Date & time of the transaction

- Type of transaction (buy, sell, swap, reward)

- Amount of crypto involved

- GBP value at the time (spot price)

- Exchange or wallet used

- Transaction fees (these reduce your taxable gain)

Example Transaction Records

Recommended Tools

Manual spreadsheets work for small portfolios, but most UK investors benefit from using crypto tax software:

Popular UK Crypto Tax Tools

Pro Tip: Connect your exchange APIs early in the tax year. Automatic syncing reduces errors and ensures your GBP values are always accurate — especially useful if you trade frequently or stake ETH regularly.

Tax Deadlines & Reporting

If you owe crypto tax in the UK, you'll usually report it via Self Assessment.

Important UK Tax Deadlines

Offsetting Losses

Selling crypto at a loss isn't always bad news — you can use those losses to reduce future tax bills.

- Claiming Losses: Report capital losses to HMRC in the same tax year. They can offset gains on other crypto assets or even other investments.

- Carrying Forward: Unused losses can be carried forward to offset gains in future tax years — just make sure you report them within four years of the loss.

Pro Tip: Even if your net gains are below the annual allowance, report losses so you can bank them for future use.

DeFi & Grey Areas

DeFi protocols — lending, liquidity pools, yield farming — introduce additional tax complexity.

- Deposits: May or may not count as disposals depending on whether you change beneficial ownership of the tokens.

- Rewards: Usually taxable as income when received, at GBP market value.

- Withdrawal: Can trigger CGT events if you receive different tokens back or realise a gain.

HMRC's guidance on DeFi is still evolving, so the safest approach is to keep detailed records of every deposit, withdrawal, and reward.

Common Mistakes

Avoid these pitfalls to keep your tax reporting accurate — and stress-free:

Common Tax Mistakes to Avoid

- <strong>Ignoring crypto-to-crypto trades:</strong> Swapping ETH→BTC is a CGT event, even if no GBP is involved.

- <strong>Not recording GBP values:</strong> You need to know the GBP value at the time of every transaction.

- <strong>Forgetting staking rewards:</strong> Staking yield is taxable income at receipt — don't wait until you sell.

- <strong>Assuming "HODL = no tax forever":</strong> Holding isn't taxable, but once you sell or swap, HMRC expects a CGT report.

Pro Tip: Use crypto tax software or hire an accountant experienced with digital assets to avoid costly errors.

FAQ – UK Crypto Tax Guide

Get answers to the most common questions about UK cryptocurrency taxation